A "How To" Guide for the Debt Snowball

Aug 19th 2020

If you hear the words Finance Plan, where does your mind drift to?

Ugh, how awful!

Wish I knew how…

Budgeting is essential and responsible.

So overwhelming.

Finance is my middle name!

Not for me.

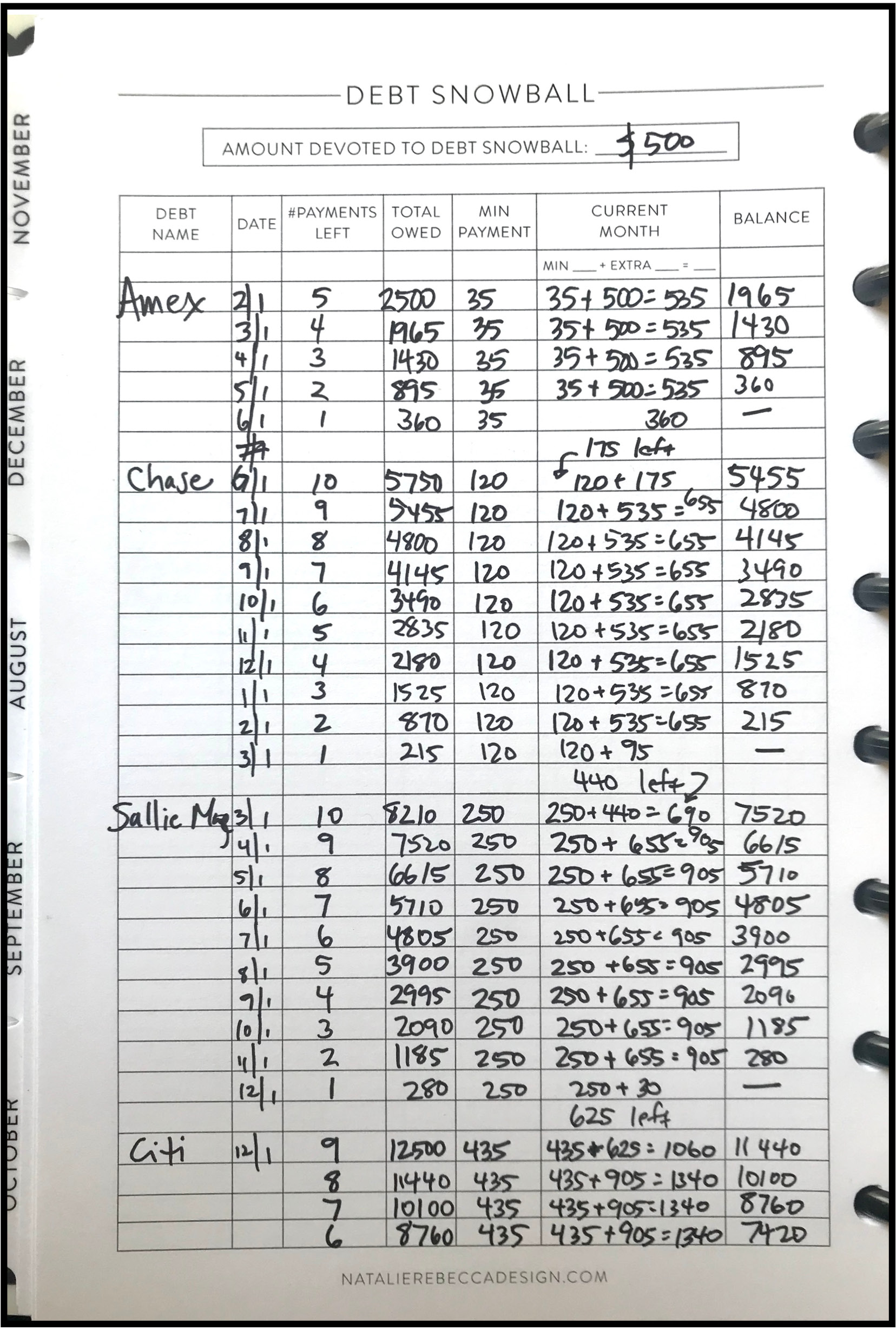

Regardless of the reaction financial planning elicits within you, you may still have questions about it. One set of organizational pages we offer here at Natalie Rebecca Design is a Finance Plan. This pack includes the following sheets: Monthly Budget, Expense Tracker, Account Information, Bill Tracker, Vehicle Maintenance, and Debt Snowball.

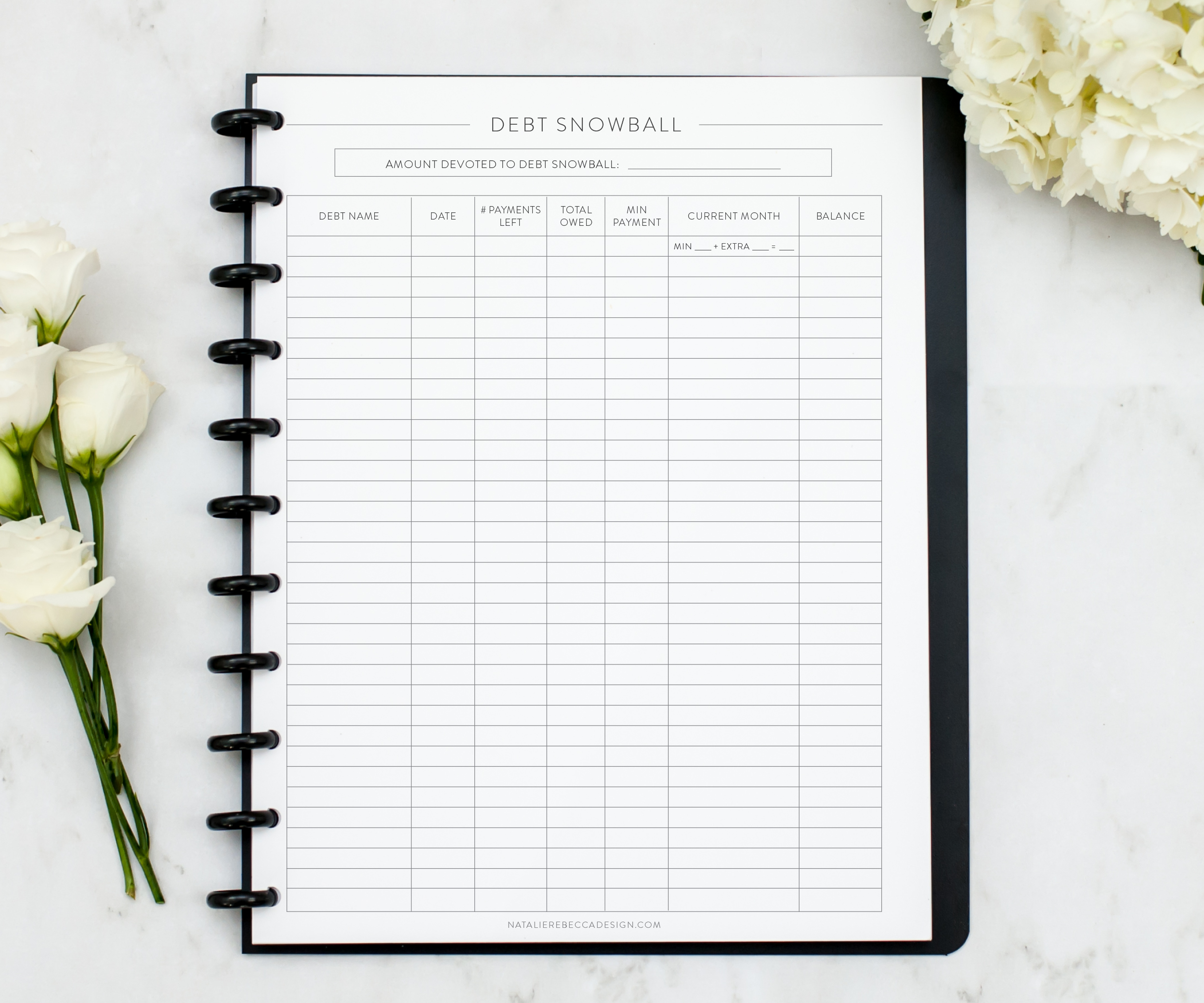

I’m guessing the one set of pages on that list that had you making a quizzical look was the Debt Snowball. Debt what? Taking a look at those pages—all the lines, all the columns, all the blank spaces—might be as intimidating as running a marathon, but in reality, these pages can help you create new habits to dig yourself out of lingering debt so you can free up your budget for bigger and better things.

So, how does the Debt Snowball work?

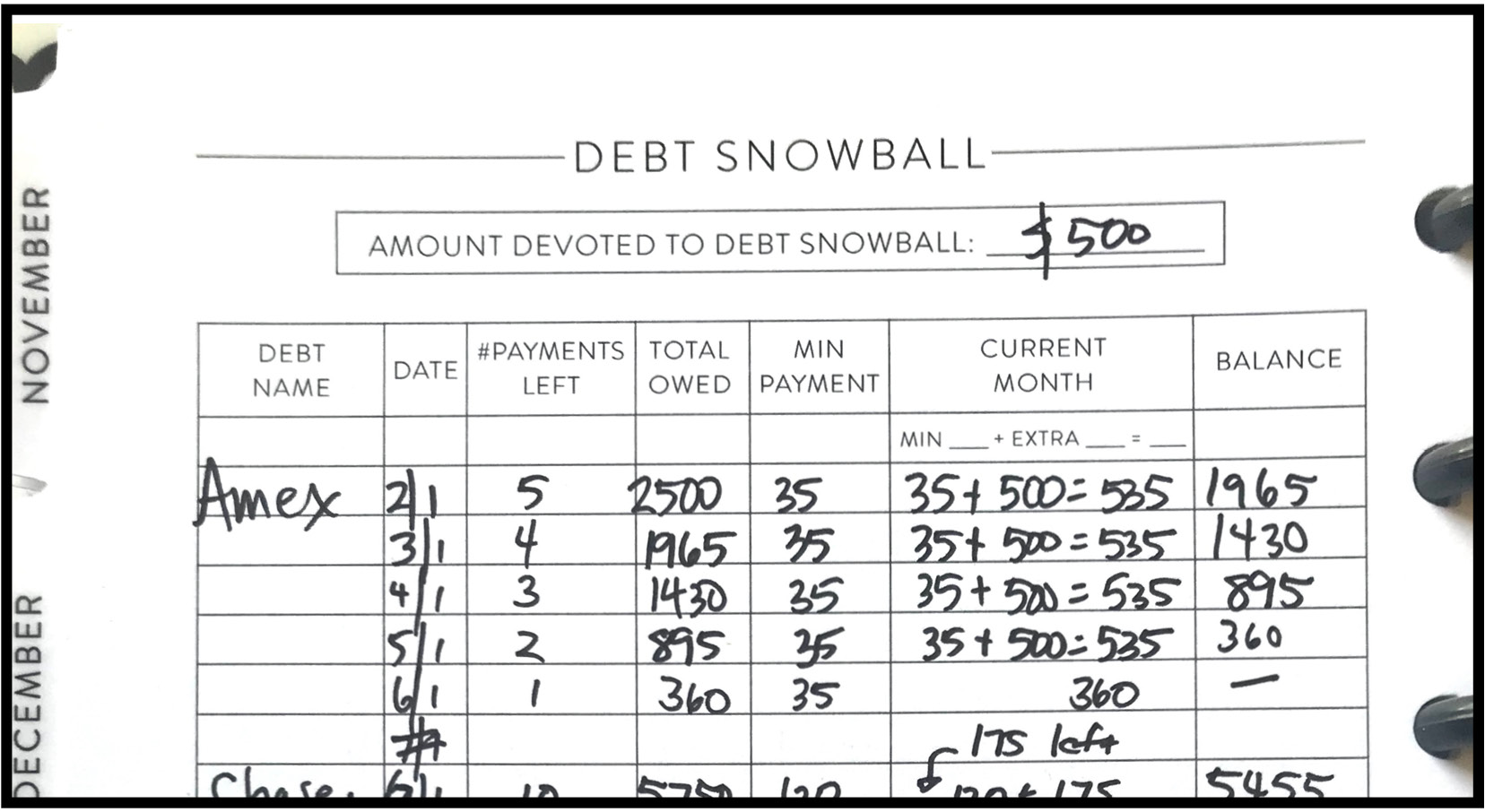

STEP ONE: Make a list of all of your debts, other than your primary mortgage, and order them from the smallest to largest (regardless of interest rate). List the minimum monthly payment required for each.

EX: Amex (credit card)—$2,500 ($35 minimum payment)

Chase (car loan)—$5,750 ($120 minimum payment)

Sallie May (school loans)—$8,210 ($250 minimum payment)

Citibank (credit card)—$12,500 ($435 minimum payment)

STEP TWO: Do your homework. Before tackling a debt-reduction plan, you’ll need to track your expenses and determine your bare-bones budget. (Finance Plan pages to the rescue!) Once you’ve done this, carve out a “debt smasher” amount that you can throw at your debt each month. Be creative and make this money count—Can you do an additional small job to earn extra money? Can you do without a subscription or two? Can you shop at budget-friendly stores?

STEP THREE: Each month, pay your “debt smasher” amount (let’s say you have $500/month to contribute) plus the minimum payment on your smallest debt, while paying just the minimum payment on all other debts.

EX: Amex—$35 (minimum payment) + $500 (debt smasher)

Chase—$120 (minimum payment)

Sallie May—$250 (minimum payment)

Citibank—$435 (minimum payment)

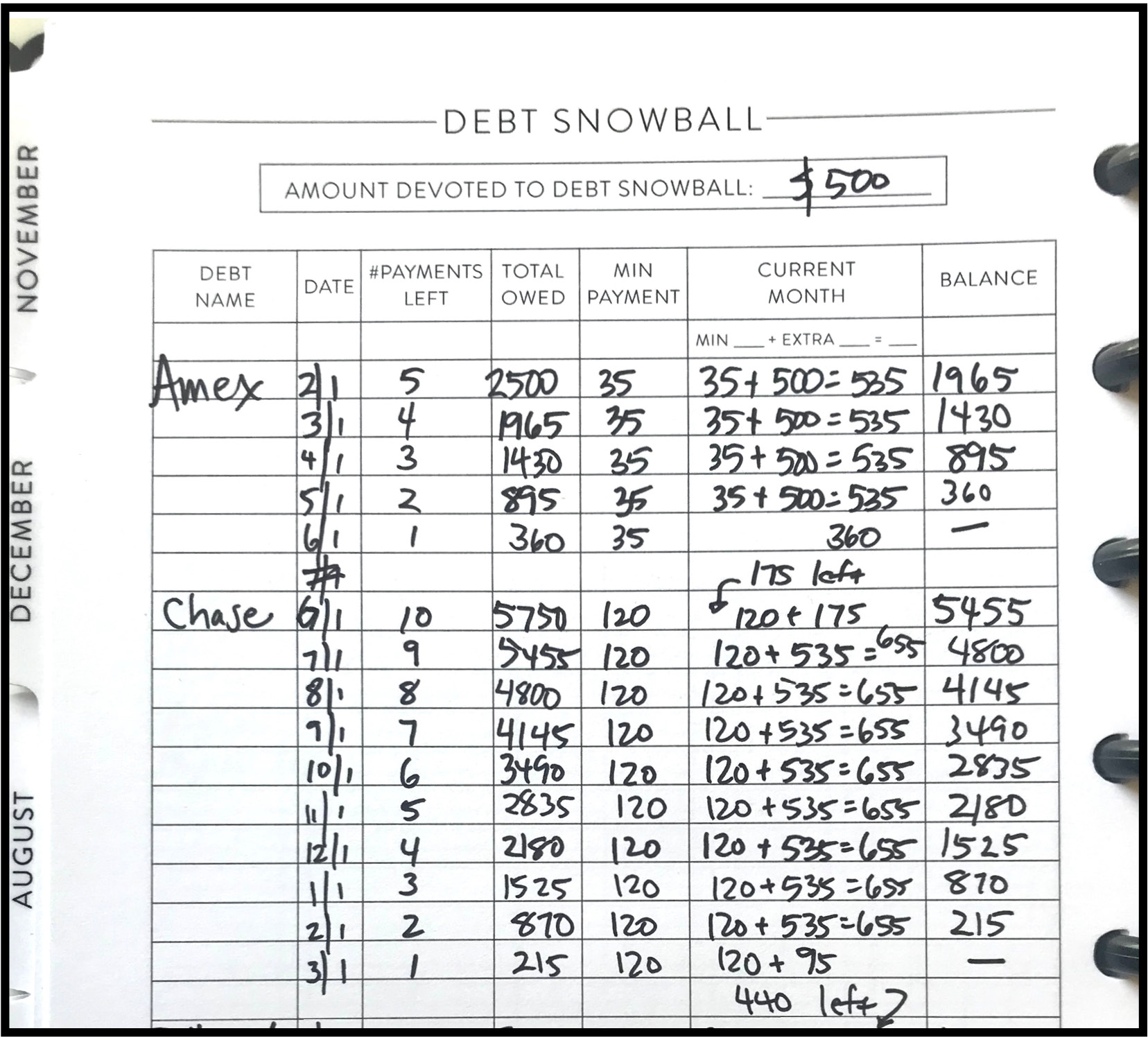

STEP FOUR: Once you’ve PAID OFF the smallest debt (yay!!), roll the money you had already been paying each month on Debt 1 into the payments you are making for your second largest debt.

EX: Amex—GONE, FOREVER!

Chase—$120 (minimum payment) + $535 (debt smasher & minimum from Debt 1)

Sallie May—$250 (minimum payment)

Citibank—$435 (minimum payment)

STEP FIVE: Congratulate yourself! Look at how much you are already contributing to Debt 2 now! You’re going to pay off Debt 2 in due time, just like Debt 1, and you can be proud of yourself for your hard work and stay motivated to continue working towards your goals.

STEP SIX: Continue to repeat the process until you are fully DEBT FREE! By the time you’re paying on the bigger debts, you have so much cash freed up from paying off the earlier ones that it creates a debt snowball. Plus, by ditching the smallest debt first, you get to see progress—quickly—and know that you can stick with the process. (And it doesn’t hurt that you get to do it with some pretty awesome-looking organizational pages…)

Even if you’re experiencing the wins of paying off debt, staying motivated might be hard. Consider some of these suggestions:

- Create a visual reminder of your money goal—toss in a notes page or to-do list page right after your debt snowball with a list of things you want to do once your debt is paid off.

- Find people who can keep you accountable—add in a contacts sheet with reminders of people who are on your team and can encourage you when you feel discouraged.

- Remember how far you’ve come—look back at your previous debt snowball pages to see all you’ve accomplished so far!

Be creative in how you throw extra money at your debt. Discover a $5 bill in a pair of pants? Set it aside. Receive an unexpected rebate check in the mail? Extra debt smasher. Decide to have a yard sale? That money is spoken for. Want to round up the money you spend on your everyday purchases? There’s an app for that. Gather up all your unexpected money in a safe place and then deposit that towards your debt at the end of each month. Be sure to list these wonderful little extras out in your finance planning pages so you can see just how quickly a few “snowflakes” can become an important part of your snowball.

NOTE: Our Debt Snowball pages also work with the “Debt Avalanche” method (which pays the debt with the largest interest rate first).

Interested in more tips and tricks? Subscribe to our newsletter here (and get a $5 coupon code!) and follow us on Facebook and Instagram.

Looking for ways to get (and stay!) organized? Check out our shop that features organizational products designed just for you!