Expense Tracker - Not Just for Spending

May 26th 2021

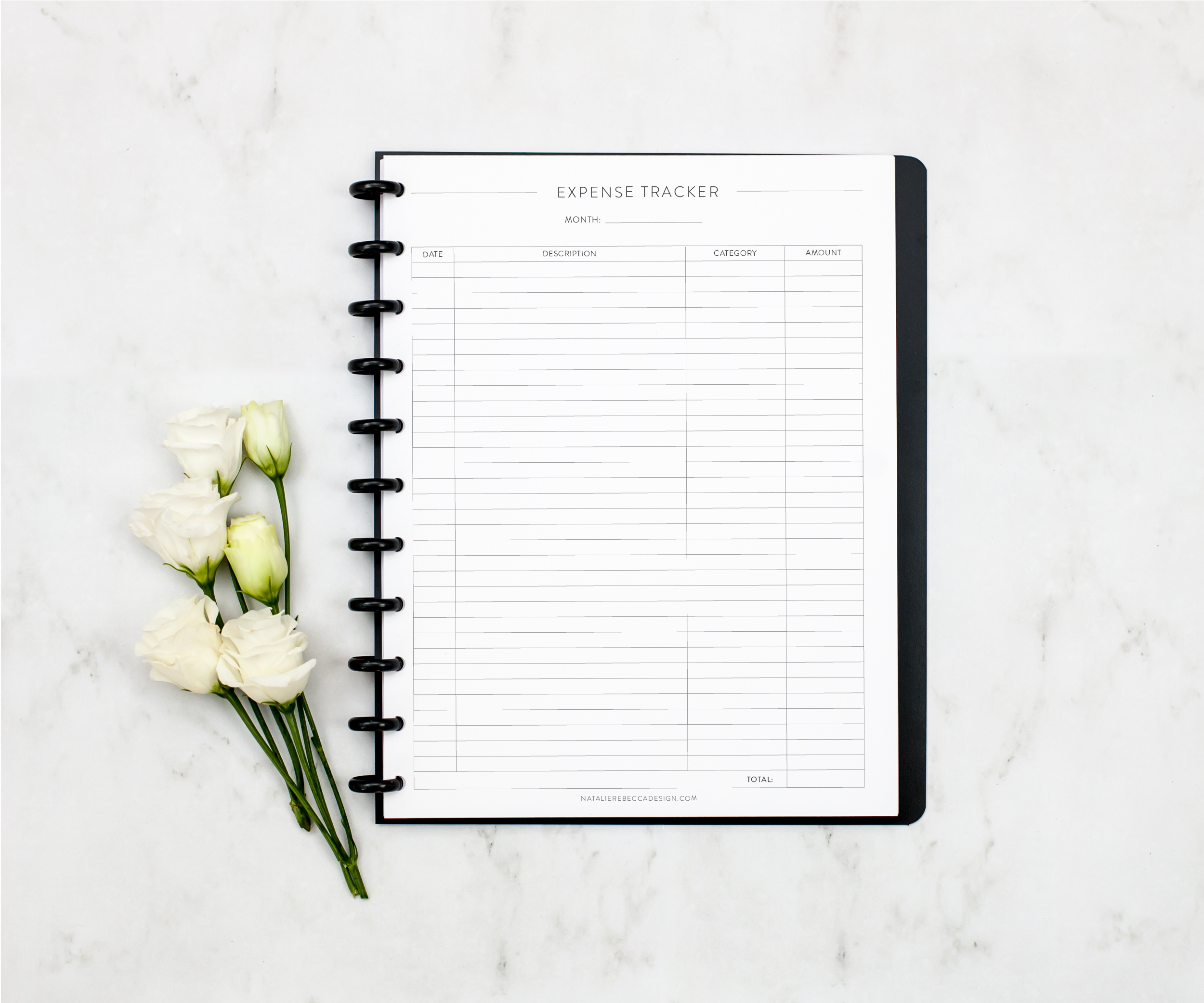

When you think of an expense tracker, your mind likely thinks back to the days when you’d write checks for almost everything and keep track of those expenses on the ledger. Now our expense trackers often come in the form of online credit card or bank statements. Some apps can even sort your spending into specific categories you set up. All this might leave you questioning, “Is there any need for a pen-and-paper-type expense tracker anymore?” We think so!

Like the other products we’ve been highlighting the past few months, Expense Trackers can be a versatile insert to meet needs that other methods or tracking systems just can’t. Sometimes it’s helpful to have a designated place to track financial information in an easy-to-view way. As you’ll see, this insert can be repurposed for both expenses and earnings, and for situations that include both the personal and professional aspects of your life. Let’s dig in!

In the most traditional sense, the Expense Tracker insert is just that--a way to track expenses. At first thought, it might seem like this requires you to meticulously write down all your daily expenses. But that’s not necessarily the case. These inserts are a helpful way to track any areas of finances that you might not itemize or track with other systems.

Medical Expenses

Medical spending can be a large portion of expenses for some families. After all, in addition to doctors visits, this spending can include dental work, eye exams, physical therapy sessions, prescription medications, and dermatology work, not to mention unexpected medical events. Expense Tracker inserts can help families monitor the bills that they pay for these sorts of medical needs. They can easily compare these expenses to what gets covered by insurance and adjust for what they've had to pay out of pocket. This method is a good first step if you are considering getting a flex spending card or switching to an HSA--it’s helpful to know just what expenses you are regularly incurring in order to choose the right plan for you and your family.

House Projects

Home projects or renovations can sometimes drag on for weeks or months, and it’s easy to lose track of expenditures in the process. Listing out the costs of different parts of a house project can help keep the renovation on budget.

In a similar fashion, it’s a good idea to keep track of the home upgrades and updates you do, as it might come in handy in the future if you decide to sell your house. Having documentation and reminders of the many projects you’ve completed on your property--both big and small--can be helpful for prospective buyers.

Maintenance and Bills

We all have the standard household bills we pay every month, most likely through mindless direct withdrawal platforms, but sometimes it’s nice to track these bills to make sure you’re noticing upcharges, unexpected increases, or rate changes. In addition to documenting these regular bills, you may have added a lawn service, termite and pest control company, warranty coverages, or occasional mosquito treatments that you’d like to track your expenses for.

This can be especially helpful if you live with roommates or rent out a property where multiple people need to contribute to bills and maintenance fees.

Extra Income

Ever get an unexpected tax refund, or a bonus from work, or perhaps a family gift or inheritance? It feels good to use those finances for something you’ve wanted but perhaps haven’t had the means to accomplish. This money can be deposited into a separate account, but accounted for on an expense tracker. If you’ve received $4,500 in extra income, how do you want to spend it? It’s possible that all that money can go to one single item, but more often than not it can contribute to several projects or purchases that you can track using the Expense Tracker. Perhaps you’ve been needing new pots and pans and the set costs you $400. Now you have $4,100 left. You’d like to hire a carpenter to add built-ins to your family room which ends up being $1,800. With the remaining $2,300 you decide to have your carpets cleaned, treat yourself to a nice dinner, add to your investments, etc. Regardless of what you chose to do with that extra income, tracking it helps you to be purposeful in your spending.

Pet Expenses

Pets can definitely be an expense category all on their own! If you’d like to be mindful of what you're spending on your furry family members, an Expense Tracker can be of value. Food, toys, vet visits, grooming, pet insurance, and other needs can be listed out to help you curb unnecessary spending and budget appropriately each month.

Trips and Vacations

Between the cost for booking a hotel, eating out, and going on excursions, trips and vacations can really take up a large chunk of your yearly budget. And yet, they create priceless memories and nudge you to take time away from the daily grind to spend relaxing, enjoying friends and family, and experiencing new things, which make them an essential part of life! Keeping track of what you’re spending prior to and during a trip simply makes good financial sense. Additionally, it’s often nice to have an accurate record of what you spent so you can refer back to it later and budget appropriately in the future.

Donations and Deductibles

Many of us have probably had the experience where tax season rolls around and we want to itemize our deductions from the year, but it feels like a daunting task because we have to search back through receipts and records...which may or may not be neatly filed in one central place. Having a simple Expense Tracker page in your planner is an easy way to jot down donations and other deductible items throughout the year.

Business Expenses

There hasn’t been much travel lately, but hopefully a return to normal business operations is on the horizon. If you’re someone who travels for work and needs to keep a log of mileage, travel, or dining expenses, an Expense Tracker can be really helpful. It can travel wherever you go for an easy way to keep track of items for reimbursements or write-offs.

Even if you don’t travel, you may work in a job, such as a contractor, where you log time for a variety of clients. The Expense Tracker can help you track hours or charges you need to bill for. The pages can be used monthly and list all the different clients or be separated out by client or project.

Earnings

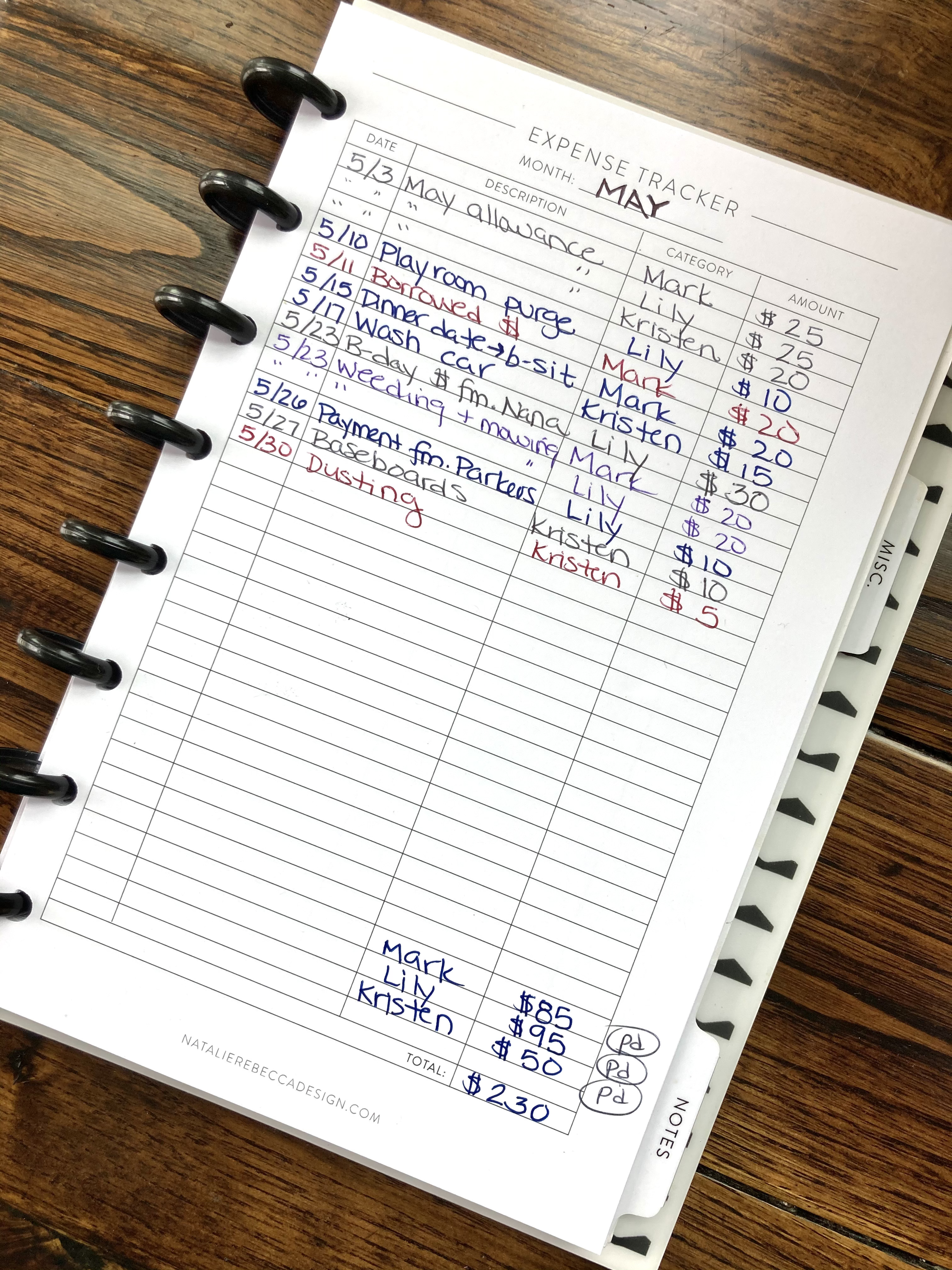

Wait. Earnings? Isn’t this an expense tracker? Yes, but in its truest form, this is simply a financial tracker. Though “Expense Tracker” is listed at the top, it really can be purposed for so much more than expenses. Here are some of our favorites, for both grown-ups and kids alike:

- Hourly rates you’ve spent on a side project or job that you plan to bill someone for at set time increments (such as repair work, tutoring, painting, woodworking, sewing, etc.)

- Money that has come in for a fundraising initiative

- Money kids have earned for allowance or extra chores around the house (and you don’t want to forget to pay them)

- Money kids have earned from babysitting or small jobs they’ve done for neighbors (and perhaps the neighbors have Venmo-ed or PayPal-ed you instead)

- Money you owe your kids because they have cash but you don’t and you’ve borrowed from their wallets (just keeping it real here…)

Savings

Let’s not forget--in order to have any money to spend you need to have money saved. What are you saving for? College tuition? A new car? A big trip? A wedding? The Expense Tracker can be an easy way to list out the money you are setting aside in a special account to be used for a specific purpose. It’s motivating to see written out in front of you how several small, purposeful reserves of money build up into larger savings overtime. The basic, user-friendly layout of this tracker is also perfect for kids to use who are trying to learn the art of saving up for their needs and wants.